39 yield to maturity coupon bond

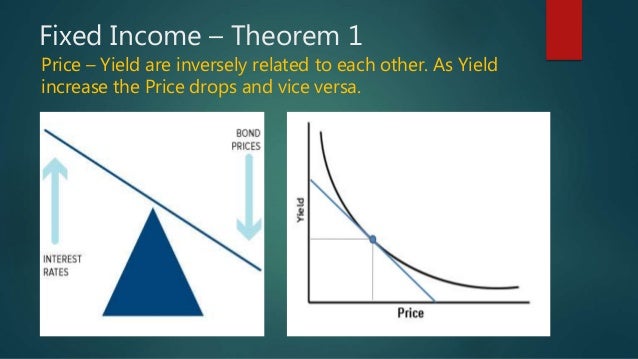

When a bond's yield to maturit - Eliteprofessionalwriters.com When a bond's yield to maturity is greater than the bond's coupon rate, the bond will: a. Not enough information b. Sell at a premium c. Sell at $1,000 d. Sell at a discount. True or false: All other factors equal, the longer the maturity on a bond, the more sensitive is its price to changes in the YTM (longer maturity = greater price ... How to Calculate the Price of Coupon Bond? - WallStreetMojo The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Therefore, the price of each bond can be calculated using the below formula as, Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $1,041.58

iShares Inflation Hedged High Yield Bond ETF | HYGI Benchmark Index BlackRock Inflation Hedged High Yield Bond Index. Bloomberg Index Ticker USIFHYG. Shares Outstanding as of Jun 24, 2022 100,000. Distribution Frequency Monthly. Premium/Discount as of Jun 24, 2022 -0.08. CUSIP 46431W549. Closing Price as of Jun 24, 2022 25.36. 30 Day Avg. Volume as of Jun 24, 2022 0.00.

Yield to maturity coupon bond

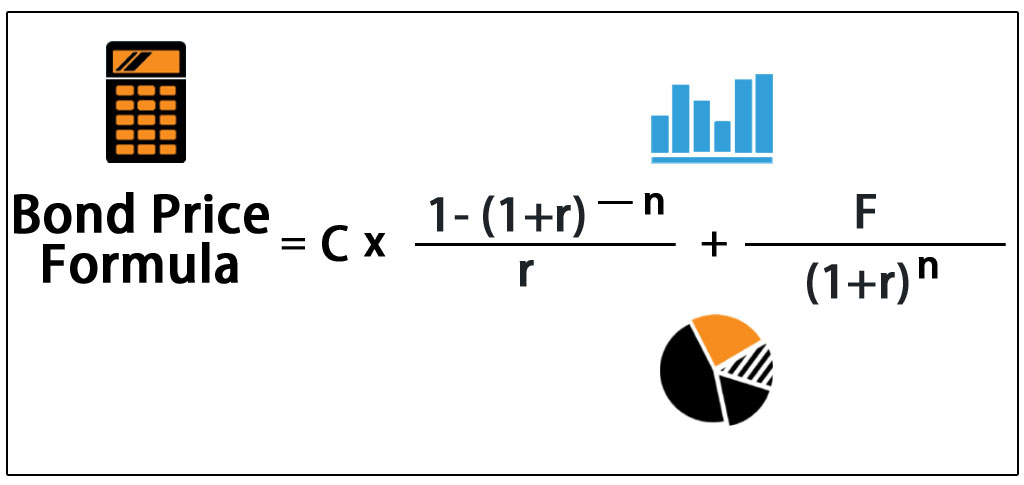

Bond Basics: Issue Size and Date, Maturity Value, Coupon Coupon and Yield to Maturity. The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds

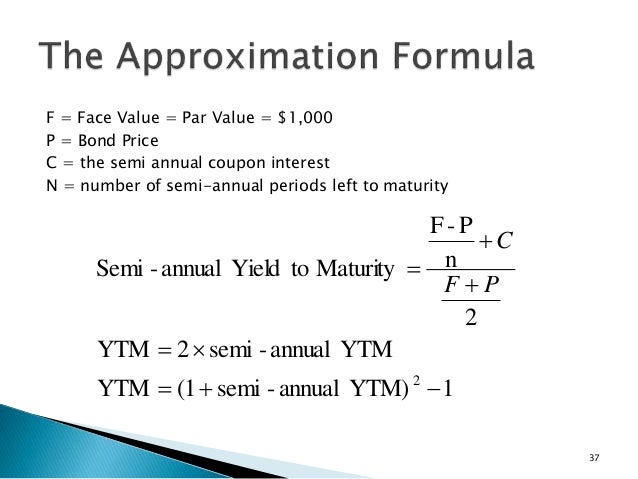

Yield to maturity coupon bond. Calculating the yield to maturity ytm of bonds these d. If the yield to maturity remains constant, the price of the bond will decline over time. 4. Bond X has an 8% annual coupon, Bond Y has a 10% annual coupon, and Bond Z has a 12% annual coupon. Each of the bonds is noncallable, has a maturity of 10 years, and has a yield to maturity of 10%. Answered: (Yield-To-Maturity) for $990. You have… | bartleby Explain your answer. (Hint: The answer is an exact percentage, virtually no calculation needed.) (Yield-To-Maturity) for $990. You have just bought a 5% coupon $1,000 face-value bond with 3 years until maturity (a) Construct the timeline that represents the discounted cash flow. Write down the equation that would calculate the yield-to-maturity ... Yield to Maturity (YTM) - Definition, Formula, Calculations Use the below-given data for calculation of yield to maturity. Coupon on the bond will be $1,000 * 7.5% / 2 which is $37.50, since this pays semi-annually. Yield to Maturity (Approx) = ( 37.50 + (1000 - 1101.79) / (20 * 2) )/ ( (1000 + 1101.79) / 2) YTM will be - This is an approximate yield on maturity, which shall be 3.33%, which is semiannual. › calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds So, a 10% coupon on a $10,000 bond would pay an annual interest of $1000. Again, these payments are often staggered throughout the year, so a bond holder's interest might be paid in biannual or quarterly installments. Fixed Rate Bonds – A fixed rate bond has a coupon that represents a fixed percentage of its par value.

A a what is the yield to maturity on the bond what is These bonds, which pay semiannual coupons, have a coupon rate of 9.735 percent and a yield to maturity of 7.95 percent.coupons, have a coupon rate of 9.735 percent and a yield to maturity of 7.95 percent. a.a. Compute the bond's current price.Compute the bond's current price. b.b. If the bonds can be called after five more years at a ... Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ... Understanding Coupon Rate and Yield to Maturity of Bonds From 2.375%, quoted yield increased to 2.700%. Let's see how much you'd have to pay for the same security you bought a month ago: Notice that the bond is now worth 992,494.26, cheaper compared to a month ago. That's how much you'll buy the bond with a Php 1,000,000 Face Value. Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3

Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Yield to Maturity (YTM): Formula and Excel Calculator The yield to maturity (YTM), as mentioned earlier, is the annualized return on a debt instrument based on the total payments received from the date of initial purchase until the maturation date. In comparison, the current yield on a bond is the annual coupon income divided by the current price of the bond security. Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures.

Yield to Maturity (YTM) - Meaning, Formula & Calculation Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. The coupon ...

Yield to Maturity vs Coupon - Australian Bond Exchange Yield to maturity and coupon rate are the two main measures you need to take into account when evaluating bonds for investment. The coupon rate shows you what your annual return from the bond will be and that means you are able adequately to plan your income into the future. Every bond will show you their associated coupon rate.

› terms › yYield to Maturity (YTM) Definition - Investopedia Nov 11, 2021 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and coupon payments are made in a timely fashion.

Wikizero - Yield to maturity The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. It is the (theoretical) internal rate of return (IRR ...

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond n = number of coupon payments

Post a Comment for "39 yield to maturity coupon bond"