43 zero coupon bond investopedia

Zero-Coupon Bond - The Investors Book Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero-Coupon Bond. In earlier days, companies used to raise funds from investors based on a written guarantee. This written guarantee is known as a bond. Coupon bonds provide coupons or interests at regular intervals. Zero-Coupon Bonds, as the name suggests, do not provide any coupon or interest during the tenure but repay the face value at the ...

:max_bytes(150000):strip_icc()/GettyImages-182885962-980f463243df44ba9f5495b7f5fb15c5.jpg)

Zero coupon bond investopedia

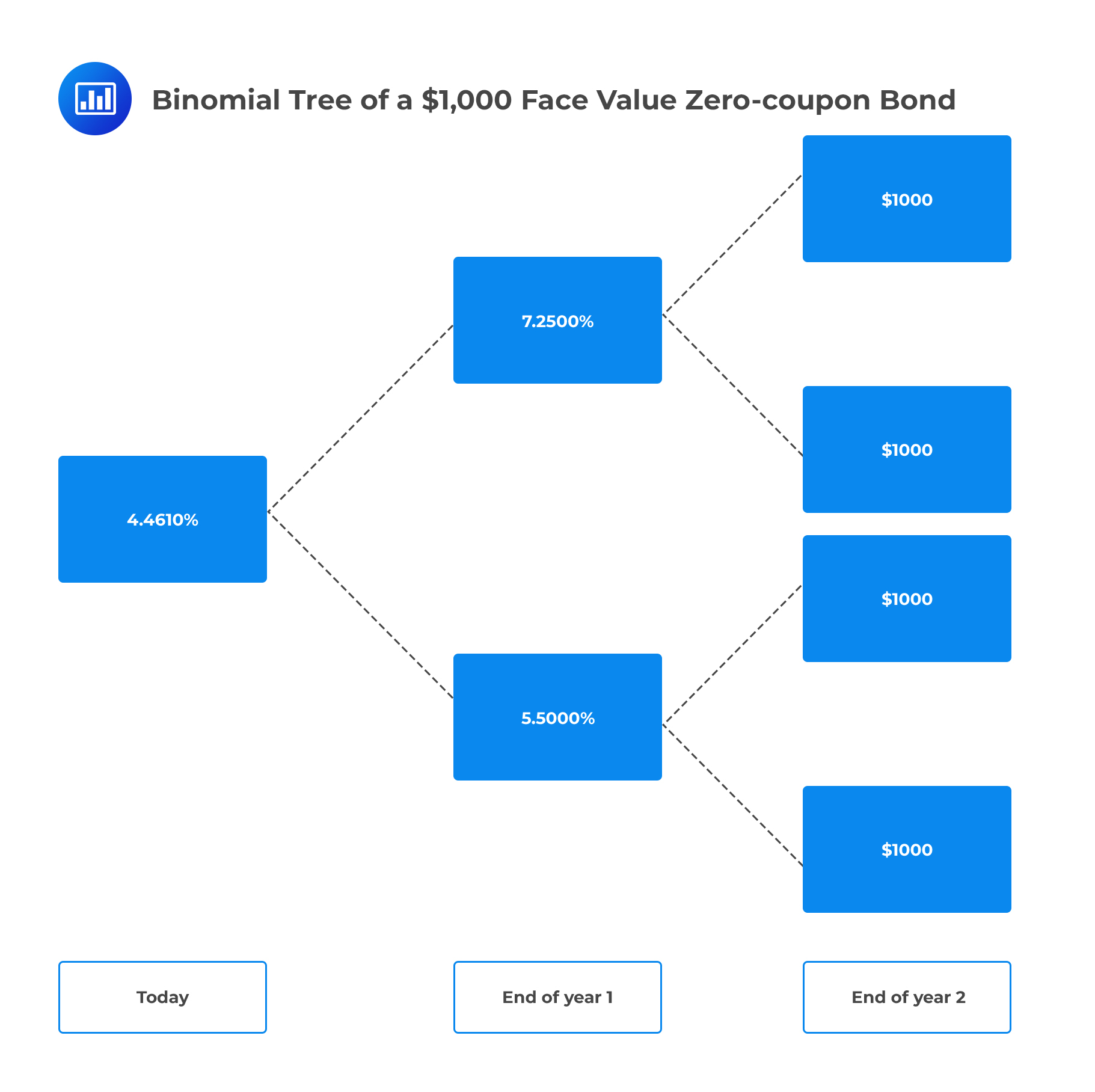

What are Zero coupon bonds? - INSIGHTSIAS These are special types of zero coupon bonds issued by the government after proper due diligence and these are issued at par. What are these special type of zero coupon bonds? These are "non-interest bearing, non-transferable special GOI securities". They have a maturity of 10-15 years and issued specifically to Punjab & Sind Bank. Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia Verkko29.8.2022 · The Macaulay duration of a zero-coupon bond is equal to the time to maturity of the bond. Simply put, it is a type of fixed-income security that does not pay interest on the principal amount.

Zero coupon bond investopedia. Zero-Coupon Bonds : r/Superstonk - reddit Zero-Coupon bonds pay no interest but trade at a deep discount and pay a profit when the bond matures. The difference between the purchase price and the value of the bond is the investor's return. ... Checked Investopedia: "Today, the U.S. Government holds market auctions every Monday or as scheduled. Four-week, 28-day T-bills are auctioned ... What does it mean if a bond has a zero coupon rate? - Investopedia A zero coupon bond generally has a reduced market price relative to its par value because the purchaser must maintain ownership of the bond until maturity to turn a profit. A bond that... How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-coupon bonds essentially lock the investor into a guaranteed reinvestment rate. This arrangement can be most advantageous when interest rates are high and when placed in tax-advantaged... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

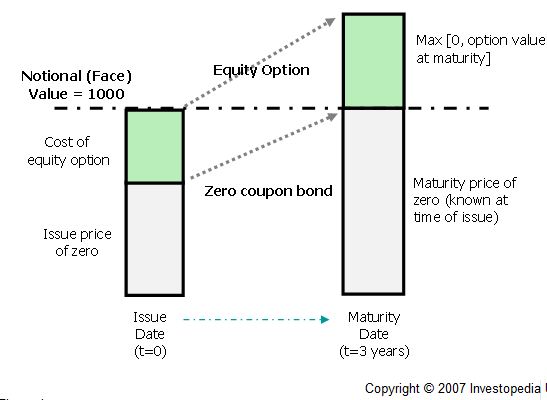

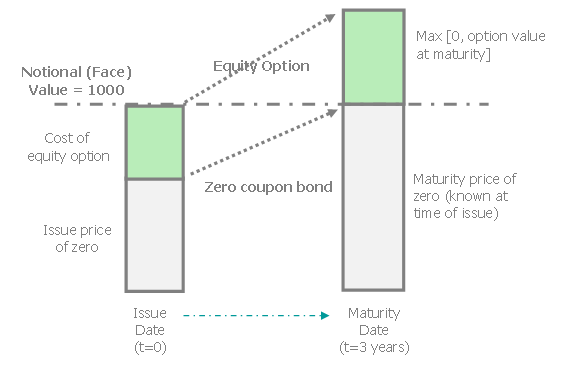

Zero-Coupon Bonds: Characteristics and Calculation - Wall Street Prep A Zero-Coupon Bond is priced at a discount to its face (par) value with no periodic interest payments from the date of issuance until maturity. Zero-Coupon Bond Features How Do Zero Coupon Bonds Work? Zero-coupon bonds, also known as "discount bonds," are sold by the issuer at a price lower than the face (par) value that is repaid at maturity. Zero-Coupon Convertible - Investopedia A zero-coupon security is a debt instrument which does not make interest payments. An investor purchases this security at a discount and receives the face value of the bond on the maturity... Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years. All About Zero Coupon Bonds - finance.yahoo.com Zero-coupon bonds are bought for a fraction of face value. For example, a $20,000 bond can be bought for far less than half of that amount. If issued by a government entity, the interest...

What Is a Zero Coupon Bond? | The Motley Fool Over the 10 years, and you will collect a total of $30 in interest, plus, at the end of the term, the company pays you back your initial $100 investment. In contrast, with a zero coupon bond with ... The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. Zero-Coupon Certificate of Deposit (CD) Definition - Investopedia The term "zero-coupon" comes from the fact that these investments have no annual interest payments, which are also referred to as " coupons ". Zero-coupon CDs are considered a low-risk... Investopedia Video: Zero-Coupon Bond - YouTube A debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full face value. For more Investopedia...

Bond Yield: What It Is, Why It Matters, and How It's ... - Investopedia Verkko31.5.2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up...

Bond: Financial Meaning With Examples and How They Are ... - Investopedia Verkko1.7.2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Coupon Rate Definition - Investopedia Verkko28.5.2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Duration Definition and Its Use in Fixed Income Investing Verkko1.9.2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ...

Zero Coupon Bonds - YouTube Why buy a bond that pays no interest? This video helps you understand what a zero coupon bond is and how it can be beneficial. It details when you should ex...

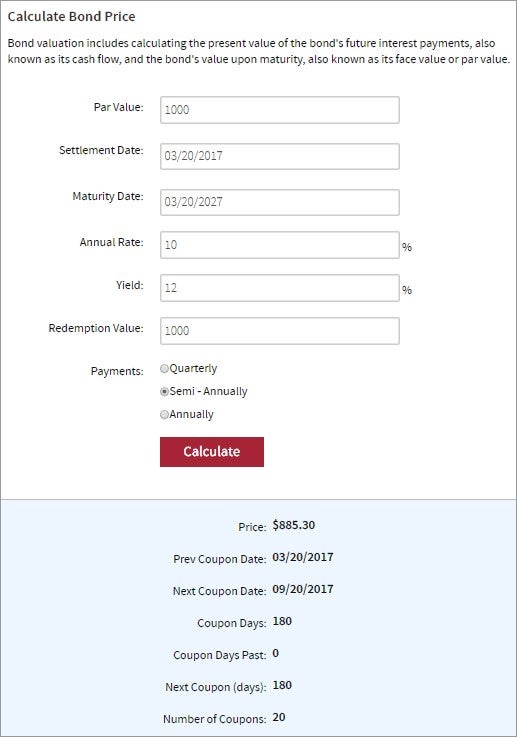

Understanding Bond Prices and Yields - Investopedia Verkko28.6.2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Essentially, when you buy a zero, you're getting the sum total of all the interest payments upfront, rolled into that initial discounted price. For example, a zero-coupon bond with a face...

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

Zero-Coupon Swap Definition - Investopedia A zero-coupon swap is an exchange of cash flows in which the stream of floating interest-rate payments is made periodically, as it would be in a plain vanilla swap, but where the stream of...

What Is a Zero-Coupon Bond? - Investopedia Verkko31.5.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

The Investopedia Guide to Wall Speak: The Terms You Need to Know to Talk Like Cramer, Think Like Soros, and Buy Like Buffett|eBook

Zero Coupon Bond: Formula & Examples - Study.com Zero-Coupon Bond Definition: The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity ...

Should I Invest in Zero Coupon Bonds? | The Motley Fool So, for instance, if you spent $750 on a 10-year $1,000 zero coupon bond, then the fact that the bond was priced to yield around 3% would mean that you'd have to pay tax on 3% of its value each ...

What Is a Bond Coupon, and How Is It Calculated? - Investopedia Verkko2.4.2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Coupon Bond Vs. Zero Coupon Bond: What's the Difference? - Investopedia Verkko31.8.2020 · A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity.

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates.

The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia Verkko29.8.2022 · The Macaulay duration of a zero-coupon bond is equal to the time to maturity of the bond. Simply put, it is a type of fixed-income security that does not pay interest on the principal amount.

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

What are Zero coupon bonds? - INSIGHTSIAS These are special types of zero coupon bonds issued by the government after proper due diligence and these are issued at par. What are these special type of zero coupon bonds? These are "non-interest bearing, non-transferable special GOI securities". They have a maturity of 10-15 years and issued specifically to Punjab & Sind Bank.

:max_bytes(150000):strip_icc()/personal-finance-lrg-3-5bfc2b1f46e0fb0051bdccb6.jpg)

:max_bytes(150000):strip_icc()/Investment_final-855f6b81c11f4634b2417a3e747628e8.png)

:max_bytes(150000):strip_icc()/GettyImages-810720992-f4dcb14dc2674174a84be79d0d538f85.jpg)

:max_bytes(150000):strip_icc()/bond-5bfc37fec9e77c00514745d5.jpg)

:max_bytes(150000):strip_icc()/shutterstock_112522391-5bfc2b9846e0fb0051bde2d3.jpg)

:max_bytes(150000):strip_icc()/GettyImages-923217650-01788d623b954f9caef5eb87c1cdb15b.jpg)

:max_bytes(150000):strip_icc()/final111-8868f6c3ce884d28b2a2aea534a65f44.jpg)

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

:max_bytes(150000):strip_icc()/savings-bonds_468446675-5bfc2b55c9e77c0026305ac4.jpg)

:max_bytes(150000):strip_icc()/GettyImages-183367591-9f457266c3734eb6bb07e4ad05e5f2be.jpg)

:max_bytes(150000):strip_icc()/investing11-5bfc2b90c9e77c00519aa65f.jpg)

:max_bytes(150000):strip_icc()/bond-final-f7932c780bc246cbad6c254febe2d0cd.png)

:max_bytes(150000):strip_icc()/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)

Post a Comment for "43 zero coupon bond investopedia"